Summer Bummer?

The Ethereum Merge, Bitcoin Cycle, and Fed's Secret Rainy Day Fund

The bears felt in control as crypto decoupled from stonks last week in the way no one wanted. TradFi rallied hard, and Defi continued bleeding or crabbed along sideways.

I thought we would get a bit more relief in crypto like in stonks, but the reality has played out differently.

Let's examine what's going on for any insight it grants.

The crypto fear and greed index remains elevated but continues a slow retreat from the highs seen early last month in the panic caused by UST and LUNA. Crypto investors are either slowly accepting that prices don’t always go up or checking out completely and not looking at their portfolios. Judging from the lack of activity on crypto Twitter and Discord, I’d say it’s the latter.

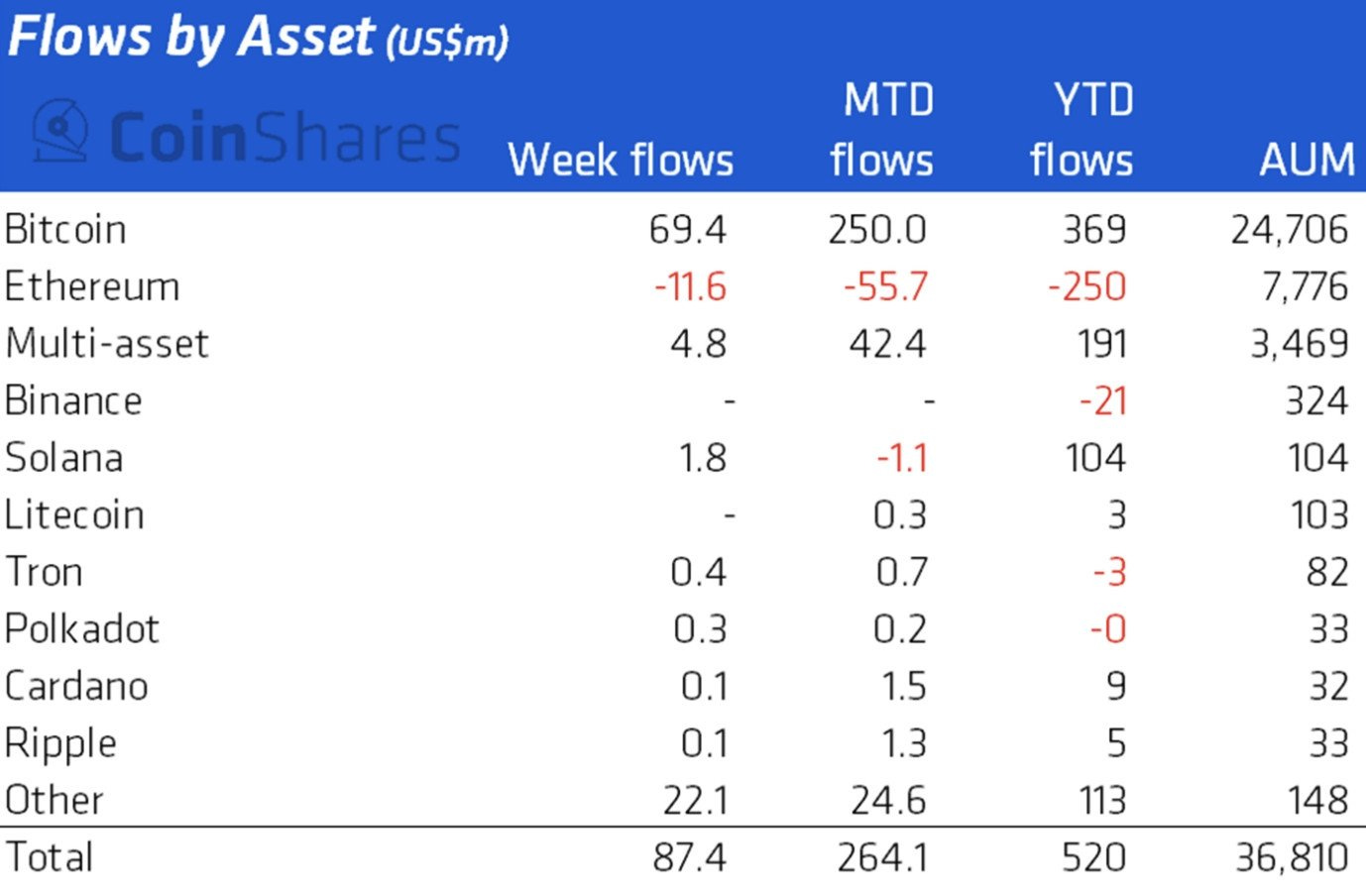

Despite Bitcoin's nine-week-long losing streak, it continued seeing strong demand from institutional investors buying the dip as Bitcoin-backed funds saw a weekly net inflow of 69.9 million. There continues to be chatter in crypto circles that the near-term outlook for bitcoin is positive and will follow stonks with a June bounce. While this appeared to start playing out with bitcoin up nearly 8% on Monday and firmly back above 30k, that rally seems to have fizzled out by today, Thursday. I remain skeptical that buying pressure can be sustained for any prolonged period for reasons we will go into below.

The Ethereum Merge

Meanwhile, Ethereum remained unpopular with investors last week and saw an outflow of 11.6 million despite the long-awaited "merge" and upgrade to a proof of stake chain announced for August.

With upwards of 12 million Ethereum ($34.5 billion) or 10% of the total supply currently locked in the Beacon Chain Eth2 staking contract, it appears investors are worried about what happens when that Ethereum unlocks to individuals, some of whom have had it out of their control for well over a year.

Imagine you bought 32 ETH at $350 in 2020 for $11,200, then in late 2020, you lock it into the Beacon Chain Eth2 Smart Contract because you believe in the project and the future of decentralized finance. Low and behold, in 2021, your dream starts coming true, and ETH balloons to over $4,500, making your 32, locked in the Beacon Contract, worth $144,000 plus any staking rewards you accrued.

However, despite this sudden windfall of cash, you do not hold that 32 ETH and have not controlled it since locking it into the Beacon Smart Contract. Therefore, you can not sell and realize any of those gains. Meanwhile, every deadline set by the Ethereum Foundation gets pushed back and delayed to the point where you are starting to doubt if ETH 2.0 will ever come and if you will ever see your locked Ethereum again.

Finally, the bear market comes, and ETH dumps to under $2,000, evaporating more than half of that unrealized 144k you thought you had.

But wait, enters Vatalik Buterin, dressed in purple, looking like the royal stallion he is, here to save the day!

He promises proof of stake, and the merge is coming in August, and that, at long last, you will get your Ethereum back. So your wife can stop threatening to divorce you and calling you dumb for taking out a second mortgage on the house to buy more "imaginary internet money that you delusionally believe will bring down the banks."

Her words, not mine.

But that begs the question: Would you sell if you finally get your ETH unlocked in August?

You can finally take the kids on a nice trip to Disney Land like the rest of the family wants, and money is tighter. You definitely could use the cash for other things.

These are the questions that smart money is asking right now, and judging by outflows, they are pricing in more downside.

While I agree with that sentiment, I also believe that if this narrative plays out, the merge might be setting up one of the best entry points on Ethereum since early 2020.

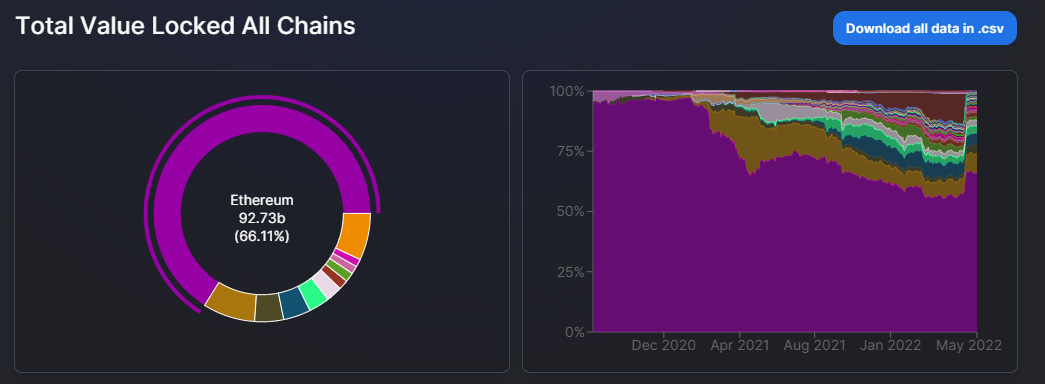

I have no clue where the bottom will be; however, I do know that despite the market cool down, the Ethereum network still dominates Defi in TVL.

At $92.7 billion today, down roughly 50% from highs in November 2021, the ETH network still has nearly a 9x higher total value locked than its closest competitor, Binance Smart Chain.

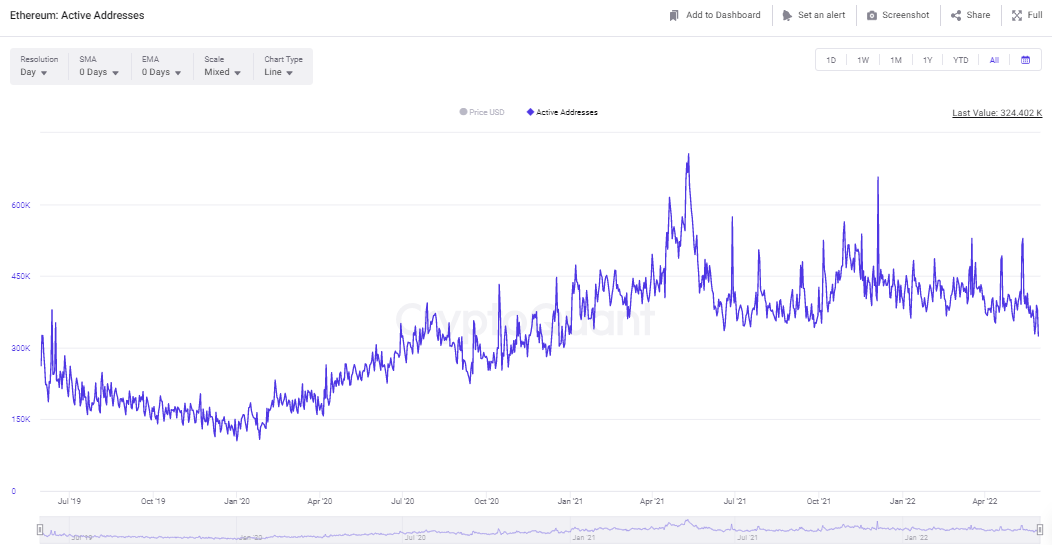

Total Ethereum active addresses still show life signs and are nowhere near the lows seen in early 2020.

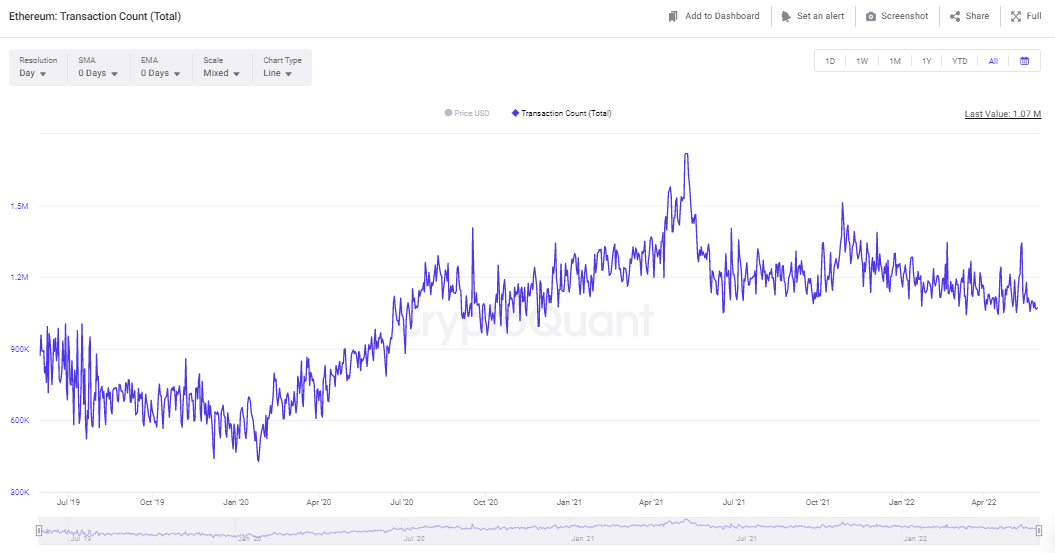

Daily total transactions are also way up over the long term and nowhere near the lows two years ago. Most interesting is that total transactions have been flat on Ethereum for almost a year now. I assume this has to do with the high cost of usage and gas on Ethereum and the subsequent migration of traffic to other Layer-1 chains and Layer-2 Ethereum solutions.

I, for one, was chased off of Ethereum thanks to high gas fees. The real test for ETH 2.0 will be solving these scaling issues efficiently where costs decrease for the end-user without sacrificing security or decentralization. It remains to be seen if Vitalik and company succeed in this endeavor, but they have one of the most brilliant teams in the world, so I wouldn't bet against them.

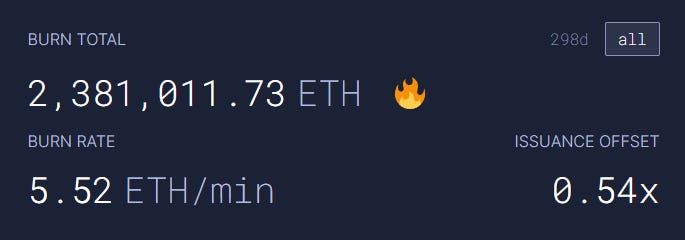

Investors are weighing two other important factors concerning the Ethereum merge: (1.) the fact that Ethereum is now a deflationary asset burning about 5.52 ETH/min, becoming increasingly scarce, and (2.) the value accrued by miners providing security and block validation will instead flow to the stakers after the merge.

Right now, the Ethereum blockchain issues about 5.4 million ($10.8 billion) new ETH a year, most of which are paid as block rewards to miners, equating to approximately a 2.1% supply inflation rate a year.

After the merge, the issuance of new ETH is expected to drop to 0.5 million/year. When factoring in the current burn rate of 2.9 million Ethereum a year, this works out to be a net decrease of the ETH supply of about -2% a year.

The upgrade, in theory, will free up roughly $9.8 billion in market value currently paid to miners to validate and secure the network, paying it instead directly to stakers through both the burning mechanism and fees collected from users of the network.

This ultimately means that the potential yield possible from running an Eth2 staking node should increase post-merge. Therefore, if your goal is to own 32 ETH and run a staking node before it is entirely out of reach of ordinary people, it's worth watching what happens come August because it might be the last chance we plebs have to own a piece of the future financial system.

For me, ETH gets interesting under $1500, but I'm not backing up the truck for anything over $1000. ETH at $1000 would have seemed impossible just a few short months ago, but it would not be out of character in the history and cycles of the crypto market.

If you are a trader looking to "play" the merge, in my mind, the projects that stand to benefit the most post-merge are Ethereum infrastructure projects like RocketPool (RPL) because it is decentralizing staking pools so holders with fewer than 32 ETH can stake and accrue rewards, and Ethereum Layer-2 solutions like Polygon (MATIC) and newly airdropped Optimism (OP). I do not hold positions in any of these projects, but it makes sense that they would benefit if the merge is successful.

It is a smart idea for experienced Defi users to use and become familiar with all Ethereum Layer-2 projects that do not currently have a token. After Optimism announced the airdrop of their OP token to users, all competing projects will inevitably do the same. That means free money is up for grabs just for making a transfer of funds and perhaps a few trades.

The two most notable Layer-2 projects to use and become familiar with are Arbitrum and zkSync.

You can use many protocols running on Arbitrum to potentially qualify for a token airdrop, the most well-known being SushiSwap (SUSHI). zkSync is a newer L2 with less built on it, but your best bet is using the ZigZag exchange to make a few trades.

Do not attempt anything unless you know what you are doing first. Using a Layer-2 chain typically requires bridging tokens from Ethereum to the L2 you are using. This process is, at times, confusing even to experienced Defi users. Be sure you know what you are doing, and send small test transactions before attempting any large ones.

The Cycles Continue

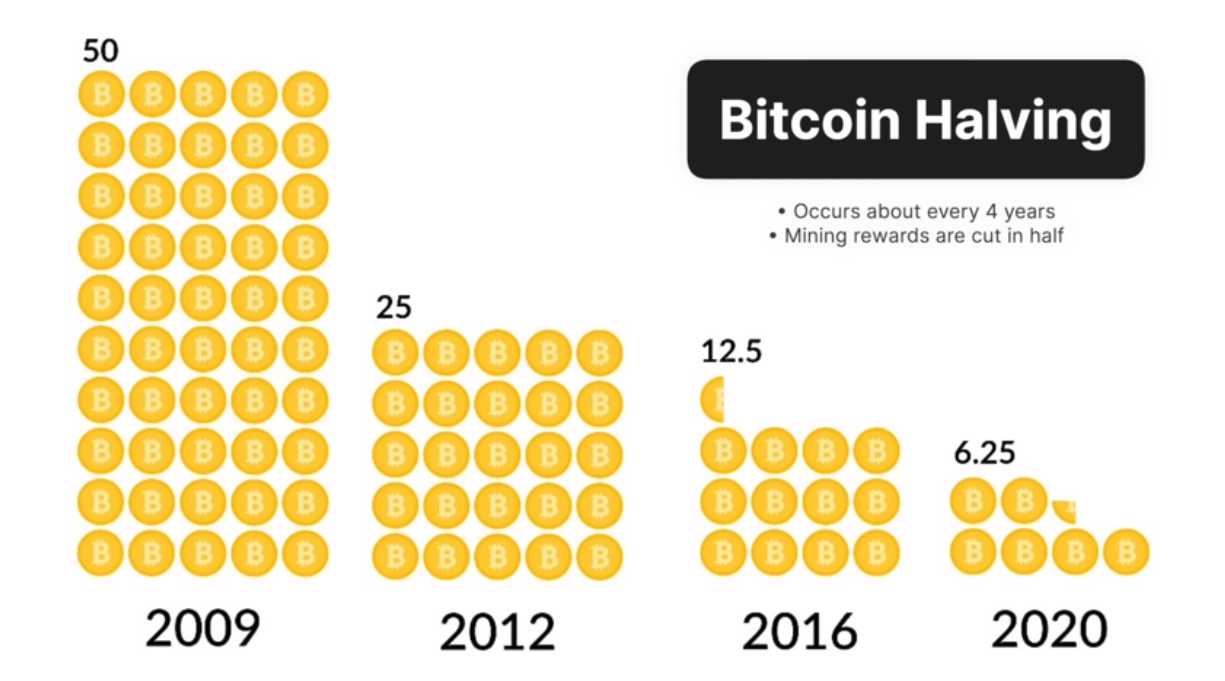

It's hard to remember when watching your portfolio get decimated by 60-90%, but the crypto market runs in cycles, typically four years long following the bitcoin halving process. What we are experiencing right now is normal and has happened before in 2018 and 2014.

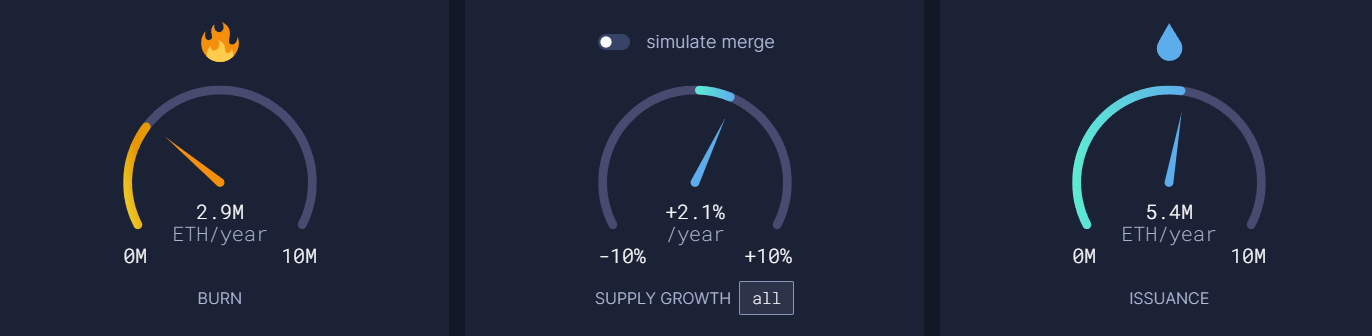

Unlike all assets that came before it, Bitcoin has a unique mechanism that cuts the amount of newly issued Bitcoin by the network to miners in half, which happens on a predictable schedule. Currently, we are about halfway to the next halving, estimated to be in early May to late June 2024.

Three big things stand out to me when looking at the Bitcoin chart and the previous three cycles.

Except for the first cycle, an outlier, the duration of bear markets in bitcoin decreases as the market cap grows and the asset matures.

The severity of bear market downturns has lessened as bitcoin grows.

During its bear markets, the price of bitcoin has not broken below the high set in the previous cycle.

Suppose we average the duration of the previous bear markets to make an educated guess on when the bottom of this cycle will be. In that case, we get an estimate of roughly 317 days, putting us at a market bottom around Sept. 23rd, 2022.

Interestingly enough, this is not long after the Ethereum merge, so if the Ethereum Foundation delays the upgrade one more month, you will know moons are alining somewhere.

Another educated guess I think is reasonable is about where the bottom will be on our projected date of Sept. 23rd. There appears to be a trend that the downturn's severity has lessened as bitcoin has aged. If we take an average decrease between cycles, we get a projected peak downturn this time of 79% from the cycle high, putting us somewhere around $14,500 BTC.

$14,500 BTC feels like an extreme prediction to me, and breaking the support of the high set in the previous cycle, in this case, 20k, would be a historical first for bitcoin. However, a flash crash scenario, especially one where Michael Saylor's rumored margin call level of 21k gets tested, makes sense to me. Saylor is a very public new whale, and it is easy for me to imagine the OG whales, who have been swimming around the market anonymously since the genesis block, wanting to put him in his place.

That's pure speculation and should be taken with a healthy dose of salt, but one should note that Saylor claims to hold plenty of collateral to pledge if just such a scenario should play out. Therefore, it is reasonable to expect any break below 20k in the bitcoin price will be bought furiously and should be looked at as a "back up the truck" type moment.

But is there anything else that might cause bitcoin to make a historic break below the support of its previous cycle's high?

Well, something is looming over bitcoin that, in its entire history, it has yet to face: a US Recession and credit tightening cycle.

The Fed Bakes the Bread

The big fat elephant in the room right now for crypto and all other asset classes is, of course, the Federal Reserve and their tightening cycle. Inflation is on everyone's mind, and the Biden administration is getting eaten alive by frustrated voters who aren't buying the "Putin price hike" narrative. The Fed and administration are desperate to get the inflation numbers under control, and therefore, we should expect them to follow through with the 50 basis point hikes they are signaling for June and July.

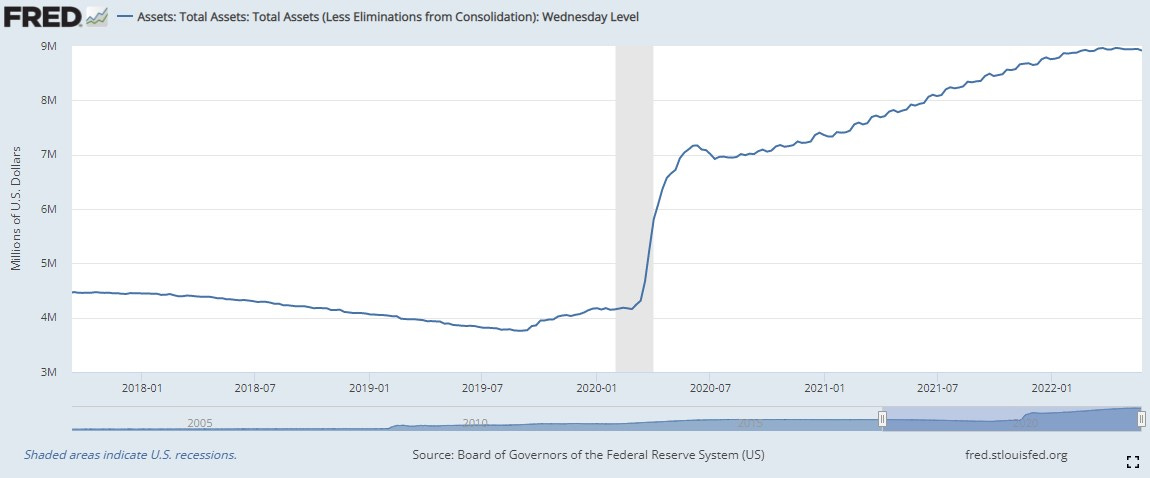

However, the Fed's slow tightening of its balance sheet might be even more crucial to asset prices and crypto than interest rates. Have trouble seeing it there? Here, let me zoom in.

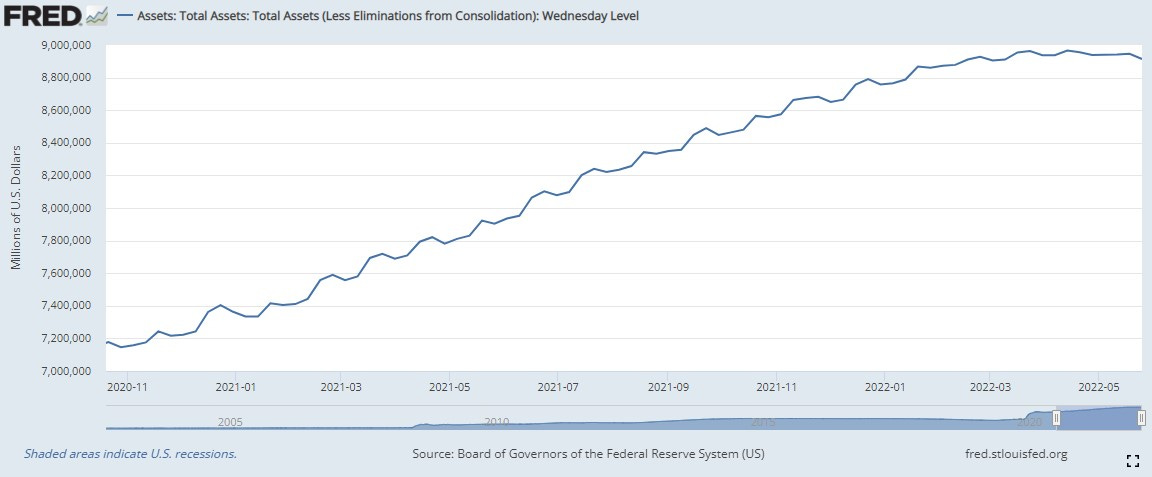

Still nothing? Shoot, one more time.

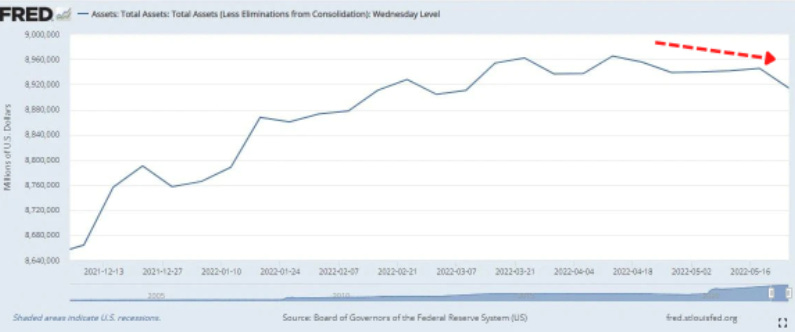

There we go. You see that tiny tick down? It is about $50 billion that have been allowed to roll off the balance sheet so far, and it has rich nerds in a tizzy. We can see it better if we change the chart to see the weekly change.

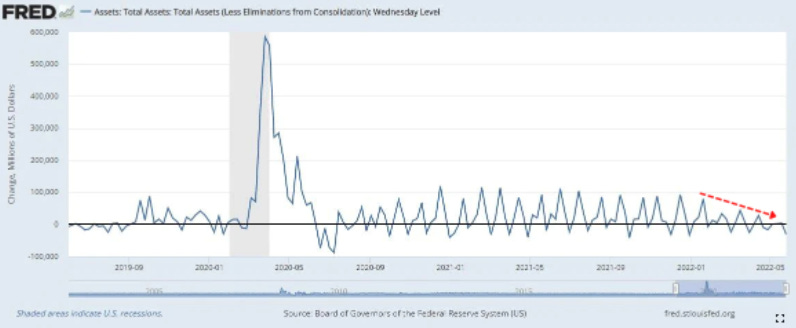

On the weekly chart, the peaks are now decreasing after an extended period of roughly the same level of weekly purchases.

The Fed is following through on its word and doing what it has been signaling for months. This move has onlookers worried because they are removing liquidity long after the period when any kind of "soft-landing" is possible. Those in charge truly believed inflation was transitory and had nothing to do with the historic monetary expansion of the last two years, only now seeing the error in their judgment.

However, admitting to a past mistake also means taking responsibility for the consequences and bringing things back into equilibrium, which in the Fed's case means destroying demand, aka causing a recession, until prices stop going up.

The good news.

The Fed's favorite inflation gauge, the core PCE, shows signs of cooling down. If it continues on this trend, there is a chance that the Fed will ease up on its tightening.

However, gas just ticked up again. Europe is in a mad scramble to secure reserves for winter. And, after a brutal 2-month lockdown that would have made our politicians blush, China is opening back up, meaning a massive amount of pent-up demand is likely about to hit the market. Oil, or energy, has a second-order effect on the prices of practically everything we use in daily life. For these reasons, I can't help but wonder if the slow down in PCE data we're seeing has more to do with the oil reserves Biden tapped into in March and less to do with any tightening from the Fed.

Nonetheless, the only thing that matters is whether or not the Fed believes what they are doing is having an effect. If so, they will slow down; otherwise, I wouldn't count on it. The oil reserves tapped in March were only enough to sustain demand for a few extra months. Therefore, we will have a better idea if the Fed is reigning in the inflation dragon later this summer.

It is important to keep in mind that everywhere is experiencing high inflation and Americans still have it good by comparison For example, in Brazil, one gas tank now costs 33% of an individual's monthly minimum wage and Turkey’s inflation just hit a 23-year high of 73%. For these reasons, central banks worldwide are in tightening cycles, with one notable exception.

As Shanghai reopens, China and the CCP, determined to make up for lost time and prove themselves the emerging superpower, are loosening monetary policy to boost fiscal spending. However, in what should be a surprise to no one, very few Chinese want to borrow when they are unsure if another lockdown is coming or not. It will be interesting to see how this plays out over the rest of the year and its effect on prices. Especially as more and more oil from Russia and elsewhere heads to China.

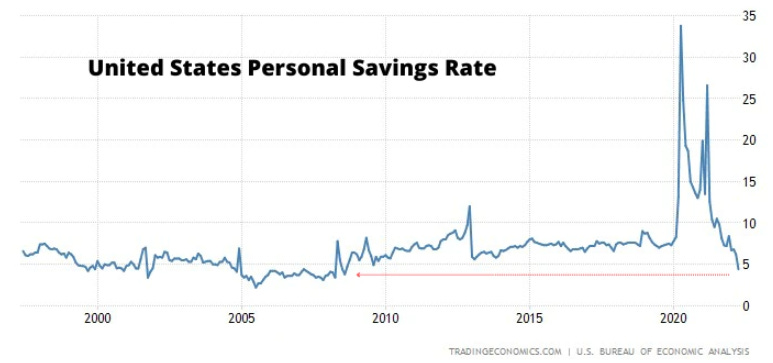

As an ominous sign of the future, the consumer is quickly going broke as they pay increased interest rates on one side and higher prices from inflation on the other. After experiencing a massive spike during the pandemic, the US personal savings rate has now collapsed to below where it was before Covid-19 and levels not seen since 2008.

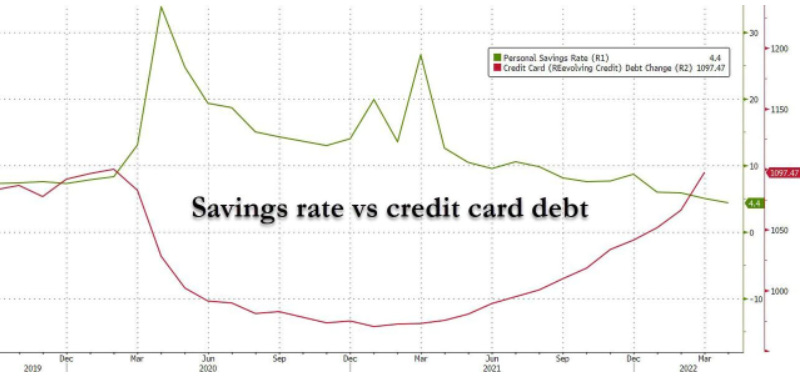

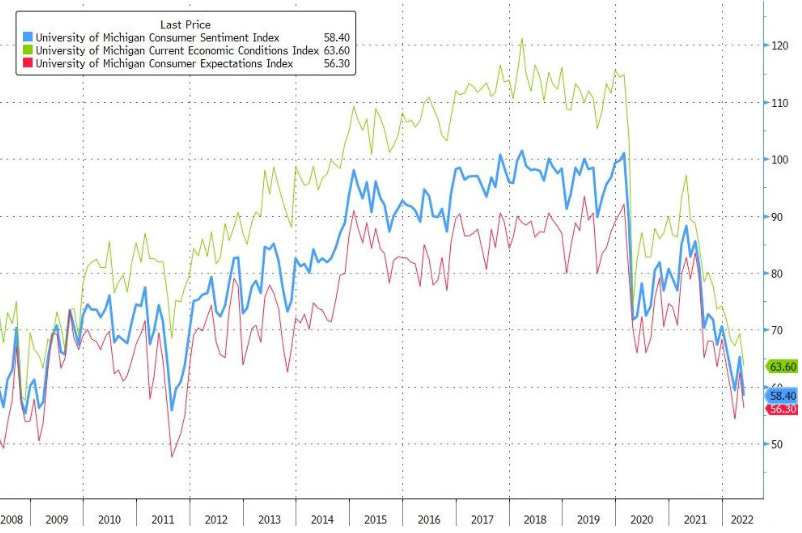

Unwilling to make sacrifices in living standards, as US personal savings decreases, credit card debt increases, indicating Americans are paying more expenses with debt as the cost of living rises, culminating in abysmal consumer sentiment, the worst in ten years.

Combined, these factors paint a bleak picture for the American consumer and the economy that relies on robust consumer spending. Nonetheless, the Fed does not care about the consumer. They do not care about savers and their crypto portfolios, 401ks, or pensions. They only care about: (1.) Proving they aren't incompetent and deserving of the monetary powers bestowed upon them by stopping inflation. And (2.) making sure their friends at the SIFIs (Systemically Important Financial Institutions) are safe and able to exit economic downturns "as quickly as possible."

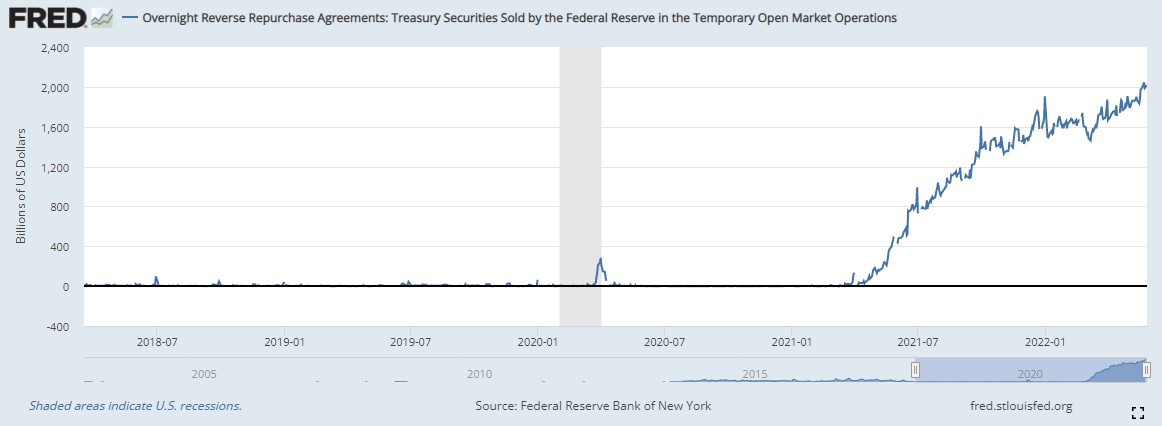

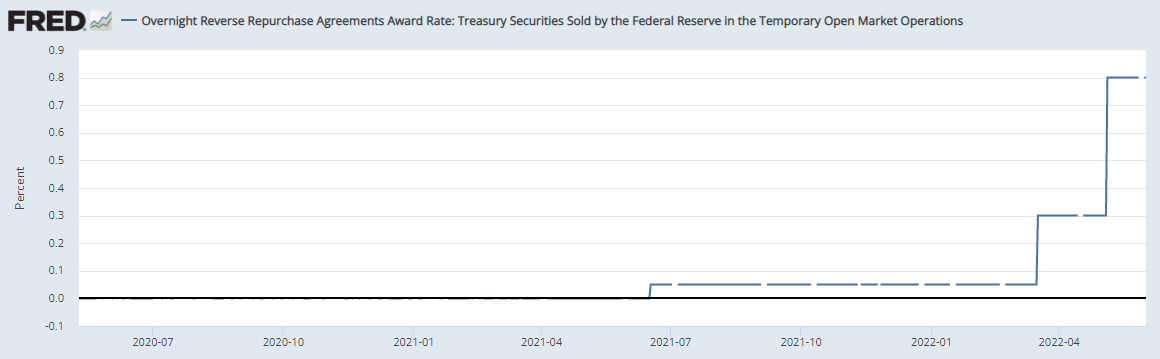

I am not expecting the market to turn bullish until a SIFI starts showing signs of stress and Powell pivots. For an early indication of this happening behind the scenes, I am keeping a close eye on the Reverse Repo account at the Fed, which just surpassed a balance of over 2 trillion dollars for the first time in history.

For the unfamiliar, the Reverse Repo account, in the simplest of terms, is the excess cash of the financial system. After 2008, regulators enacted rules on lenders requiring them to hold a certain amount of collateral on their balance sheet to offset the liability of deposits. In the banking system, cash from depositors is a liability to banks on their balance sheet because it must be payable on demand. The Reverse Repo facility offers a window for lenders with too much cash to exchange it for collateral, mainly in US treasuries and mortgage-backed securities, therefore meeting regulatory requirements.

Understandably, the facility sat unused for almost its entire history, which makes sense; it would only be used if an uncomfortable amount of banks were being loose with their lending practices. However, when Covid hit, the Fed rode in to save markets and flooded the system with newly created money and bank reserves.

The message to banks was clear, lend as much new money into existence as possible, regardless of risk and potential future consequences. So banks did just that and started hitting everyone they could think of offering a PPP loan.

Worried the lending requirements would cause the financial plumbing to break, regulators suspended those requirements. It is comically ironic that rules to prevent a banking crisis could become the very thing that causes one, but the Fed was flooding the system with so much cash that it became a genuine concern.

With a simple press release, it was a concern no more, and people across the land could take out easy loans to buy things they probably shouldn't and commit outright fraud in the middle of a pandemic.

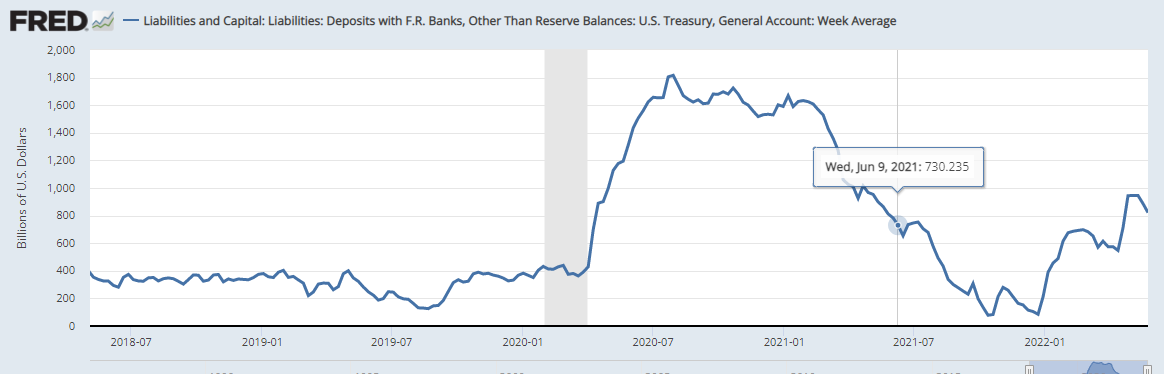

Fast forward to March 2021, markets have recovered and started booming, and the Fed wants to begin reigning things in by bringing back lending ratio requirements. Suddenly banks were sitting on a ton of excess cash from depositors that needed somewhere to go so they, the lenders, could hold the necessary collateral to meet their ratio requirements. Unfortunately, inflation had not shown its ugly face yet, and interest rates for the most pristine collateral, US Treasuries, were still next to nothing. Therefore money began trickling into the Reverse Repo account to find collateral instead of the open market.

Then in June of 2021, the game changed again when the Fed raised the rate they were paying for money parked in the Reverse Repo account to 0.30%, or 0.05% above the Fed Funds Rate at the time. This move did two things: (1.) It caused a tsunami of cash looking for risk free yield to flood into the Reverse Repo Account, and (2.) it put a floor on interest rates preventing them from going negative.

In June of 2021, as we can see from the Treasury General Account, the government was in the process of spending reserve cash held in their account and not issuing new Treasuries to raise funds. Therefore, if the excess money in the Reverse Repo account were to flood the open market, there would not have been enough treasuries to meet the collateral demand, and interest rates would have been pushed negative.

The Fed did not want this to happen and thus has kept the reverse repo rate five basis points above the Fed Funds rate ever since. If this is the case, why is the Fed keeping this money from entering the system, and what will happen with it?

I believe that the Fed is keeping this excess cash as one of their monetary "tools" to use when the need arises. With the Fed raising interest rates and tightening their balance sheet, we see a reduction in liquidity across the board. With so much cash being sucked out of the system and replaced with collateral, it is only a matter of time before a flip happens and banks start needing liquidity and scramble for cash again. At this point, I think it is likely we see something "systemically important" begin to show signs of stress. In that scenario, the Fed will push a button, lower the Reverse Repo rate, and allow that liquidity to flood the market, capping interest rates and hopefully putting out any fires in its path.

So, for the time being, I am not making any big moves and watching. The Fed is keeping 2-trillion dollars in reserve for a reason. Having the ability to solve a liquidity crisis without stopping QT or lowering rates again sounds like a reasonable explanation for their actions. When the Fed unleashes that cash, we will get our first indication that someone big is in trouble.